What is Financial Due Diligence & its Checklist

This process examines all aspects of the business, including operating margins, debt-to-equity ratios, return on assets, revenue streams, and tax implications. The financial due diligence report is

In the fast-paced world of business, where companies are often praised for creating innovative products or services, the real key to long-term success lies in carefully managing the finances. The foundation of this effort is financial due diligence, which goes beyond simple number-crunching calculations to become a strategic requirement. In order to ensure viability and chart a path for prosperity, it entails a thorough analysis of past spending, present financial situation, and future budgetary plans.

This process examines all aspects of the business, including operating margins, debt-to-equity ratios, return on assets, revenue streams, and tax implications. The financial due diligence report is therefore like a crystal ball; it shows how well a company will do in the future. Let us take a quick look at the Checklist for Financial Due Diligence and figure out the most important parts that support a company's long-term success and financial stability.

The Importance of Due Diligence

Financial due diligence is necessary for both your own company and the company you plan to deal with. It is a form of audit that examines every financial record to check if your accounts reflect the true story of your business operations.

Knowing your company's financial performance accurately is crucial in every business-related decision. To give you an example of financial due diligence, let’s consider that your company is planning to expand into a new city, or launch a new product.

While your company may have all the resources to expand, proper financial due diligence might reveal that the company will not be able to sustain an upcoming recession or slumped sales. This crucial piece of information can make or break a company.

Why Conduct Financial Due Diligence?

There are two aspects or forms of due diligence; buy-side due diligence and sell-side due diligence. As the name suggests, buy-side due diligence is when the company does a financial audit of the company they are acquiring to ensure they are making the right purchase. Similarly, sell-side due diligence is done by the company being sold to make sure that there are no issues during the transactions.

When it comes to acquisitions or mergers, it is important that the sell-side also completes a thorough due diligence of their company. This allows the buyers to run the FDD in a much smoother manner while also enhancing the seller’s credibility, reiterating that their financials are trustworthy and accurate.

With the help of this due diligence, buyers get a better understanding of the target company’s core performance standards. Financial Due diligence also provides an understanding of a company’s financial health. Through this one can develop an accurate prognosis of an organization’s finances.

The Financial Due Diligence Checklist

Preparing the financial due diligence report can be difficult and time-consuming, but some steps can be followed to make the process smoother.

Following is the FDD checklist to know and follow:

1. General Research

The purpose of financial due diligence is to research the company. If it's a company you are interested in buying, then getting all the relevant documents such as SEC filing, press reports, annual letters, etc is crucial to know about the company.

Similarly, if the FDD is for your own company, then analyzing the financial records, cost evaluation, gross margin, etc is the first step to get an accurate idea of the company’s financial health. The following is all you need for general research purposes:

i) Company description:

This includes current and future revenue streams with a breakdown of each, areas of focus, specifying target customer types based on segmentation by size, needs, or other criteria, thorough description of the company's product offerings, including the margin percentages for each product and a list of existing and under-development products and services. This also includes a study of the challenges faced by the management in running the business, factors restricting growth, and potential solutions

Next, it includes a list of key customers, collectively responsible for at least 50% of current revenues, along with their product usage patterns over the past 12 months, a list of key vendors and partners, and the competitive landscape is explored, encompassing both Indian and global competitors.

Finally, the purchasing policy and credit policy of the company are described along with a compilation of surveys and market research reports conducted by the company.

ii) Certificates: Certificate of Incorporation, Memorandum of Association (MOA), and Articles of Association (AOA).

iii) Company Structure: How the human resource has grown over the years, and a detailed breakdown of employee hierarchy and team breakup. This will also include the current shareholding breakup of the company.

iv) Intellectual Property: Details, patents, and registration certificates of intellectual property.

v) Financial Reports: Audited financial statements, along with supporting schedules, trial balances, and the CARO Report of past years. Include unaudited financials, cash flow, electronic accounting data (tally, other software logins), and the internal financial controls report for the current year. Supply six MIS reports highlighting essential KPIs such as customer acquisition cost, lifetime value, product-wise breakdown, bookings, and customer count.

vi) Investments and Subsidiaries: All company investments since inception, concerns, and details on subsidiaries and ROC master data.

vii) Documents: Legal documents including PAN, TAN, and registration certificates of all types of taxes (direct and indirect: VAT, GST, Excise, Service, PF, PT.

2. Analysis of Profit and Loss

After getting all the relevant documents in the first step, a rigorous analysis step follows to ascertain the debt-equity ratio. This is often called ‘crunching the numbers’ and requires a lot of calculations and cups of espressos. Any mistake here can create a snowball effect of mistakes, leading to inaccurate results.

i) Company Revenues: Includes trends of revenue since inception month-wise and also details on the nature of payment agreements with distributors, customers, and partners. Details on customers as per the length of the contract, active buyers, and percentage of repeat orders.

Analyze the acquisition of new customers, noting the percentage split between those opting for a single product versus multiple products. Include sample invoices, major contracts, and details of billing processes. Additionally, provide monthly statistics on online users, website visitors, conversion ratios, applications, and order fulfilment metrics.

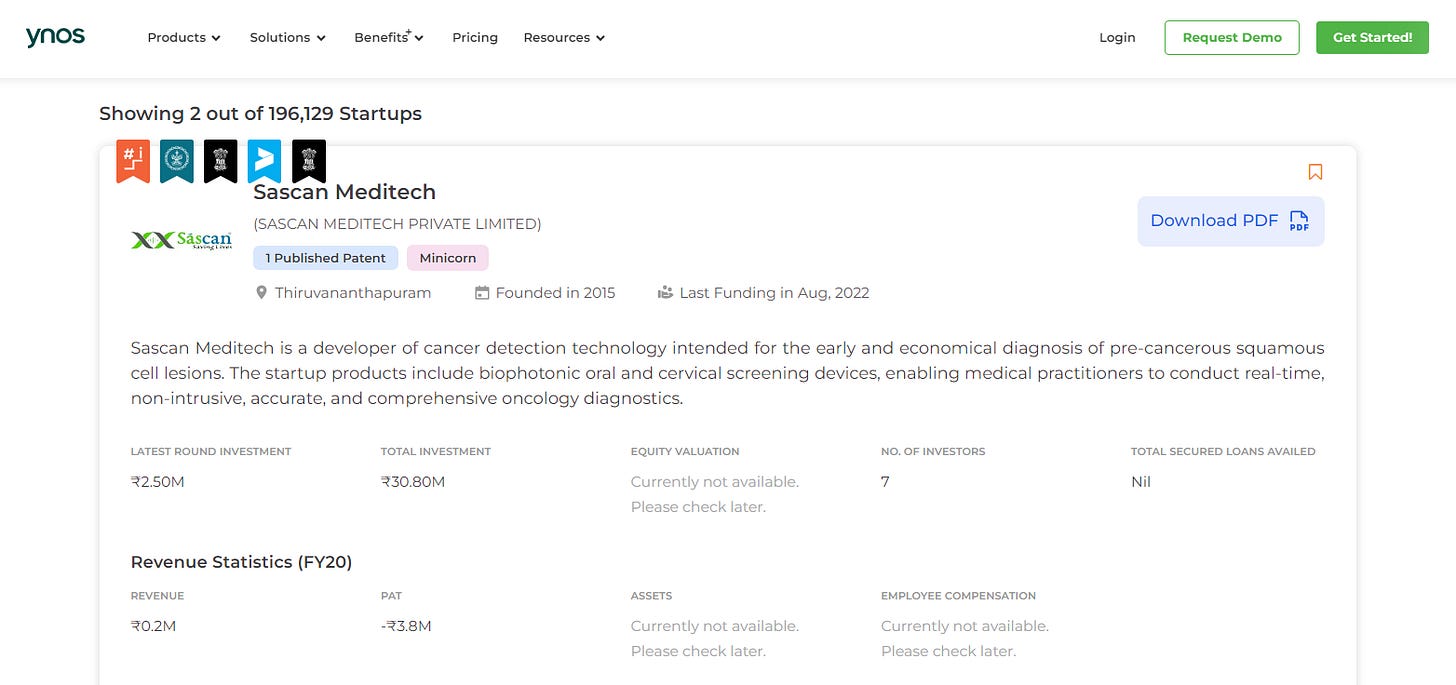

To get the accurate financials of any company, simply go to startups product under the products tab in ynos.in. Search for the relevant company through the search bar to get all their recent financials at your fingertips as shown below.

ii) Human Resource Expenses: salary register, reconciled with the GL, and relevant documents such as appointment letters, non-compete agreements, and performance matrices for sample employees. Additionally, provide information on contract labor payment, compliance, and deployment if applicable. Include details on compensation and ESOPs for promoters and the key management team.

iii) Rent Cost: Rent and lease agreements of all offices and operation centers (factories). Copy of operating lease and property leases with details such as location, lease period, and terms of termination.

iv) Legal Costs: List of and expenditure on law, accounting, finance, and consulting services availed.

v) Marketing Expenses: Trends in marketing cost monthwise and the corresponding customer acquisition. Marketing budget and actuals per annum. Also, include the settlement of customer disputes and any discounts given to customers.

vi) Technological Expenses: Cost of online tools like websites, clouds, and servers. Cost of building and running applications and websites.

3. Balance Sheet Verification

Although verification has been mentioned here separately, it goes hand-in-hand with analysis. Verification, as the name suggests, is verifying the authenticity of the reports and documents, as well as the reliability of service reviews. In a way, this process is checking if the checking process is legitimate or not.

i) Fixed Assets: Acquired and rented fixed assets, and details of any intangible fixed assets.

ii) Receivables and Lending: Details of debtors, period of debt, bad debts, and nature of lending.

iii) Cash and Liquid: Information on all bank accounts, details of bank loan statements, and sanction letters, if applicable. Present information on bank overdrafts, term loans, and term deposits in a tabulated format, specifying deposit dates, maturity, and interest rates. Submit monthly bank reconciliation statements for all accounts. Include credit card statements and details of the credit policy in place.

iv) Debts and Liabilities: Information on creditors and advances received, including an aging analysis, expected realization, and details of internal system follow-up, with confirmations for amounts exceeding Rs. 1 lakh. Second, outline details of leave pay and retirement benefit accruals, and if applicable, provide an actuary report for gratuity. Include any other payables or outstanding government dues that may be pertinent to the financial standing of the company. This will also include the nature of the debt and the reason for the loan along with their repayment schedules.

v) Taxes: For VAT, provide workings, returns, challans, reconciliation with books of accounts, and notices received, if any. Regarding Service Tax, present workings, returns, challans, reconciliation with books of accounts, and notices received, if any.

For GST, including workings, returns, challans, reconciliation with books of accounts, and notices received, if any. If applicable, detail ESIC workings, registers and returns, challans, reconciliation with books of accounts, and notices received.

For PF, if applicable, provide workings, registers and returns, challans, reconciliation with books of accounts, and notices received. Include details of PT workings, registers and returns, challans, reconciliation with books of accounts, and notices received for all employees, including directors.

For the Equalization Levy, provide details of parties, amounts paid, workings, and challans for the 6% tax on advertisements exceeding Rs. 1,00,000 in non-domestic transactions.

Key Takeaways

Being passionate about your company is important for the success of a startup, but sometimes passion can make people overlook the paperwork. Running a startup and turning it into an established business requires a lot of work, mostly on paper.

If a business is a boat, then due diligence is the paddle that keeps the company moving ahead and afloat. Yes, it will take effort to paddle the boat forward, but that’s how you can move ahead, and avoid drowning.