The Fintech Landscape of India: Consumer Lending & Personal Finance

Today, India has over 13,000 fintech startups, with approximately 1,700 focusing on consumer lending ....

India has traditionally been recognized as an agrarian economy, where agriculture has been the backbone of the country's financial landscape. For many, significant advancements in technology, particularly financial technology, were not anticipated within a developing economy.

However, over the past decade, our country has experienced extraordinary growth in its technology sector, with fintech startups in India showing unprecedented growth. Initially, this space was largely occupied by international players, but local startups have since transformed the industry with remarkable success.

Today, India has over 13,000 fintech startups, with approximately 1,700 focusing on consumer lending. These companies are not only meeting the country’s growing digital financial needs but are also transforming how financial services are accessed and managed.

The promise of financial technology is to contribute substantially to economic inclusion and the modernization of India’s financial ecosystem.

Fintech in India

The fintech industry is built on a fundamental foundation of people’s trust. In a developing country like India, where people are often cautious with their finances, building this trust is a significant milestone. Shifting from traditional to digital methods for lending, borrowing, and managing money is an achievement that underscores the industry's rapid growth and public acceptance.

This trust is further solidified by substantial investments from financial giants and support from the government. Angels, VCs and Grants account for approximately Rs 353000 Crore of investments on the Indian Fintech Industry.

Fintech has provided people with greater financial accessibility and control, enabling them to manage their finances more effectively, educating them on personal finance, and, most importantly, saving them time and money.

The sector is vast, with major sub-sectors including insurance, lending, credit, financial management, and software solutions. Below are some of the fast-growing fintech products in India and their benefits:

Digital Payments and Banks:

When the pandemic had just started, the government nudged citizens to move toward contactless digital payments. At first giants like Paytm, BharatPe and PhonePe emerged offering instant transfers, bill payments, and a convenient, cashless experience. Neobanks like Jupiter and RazorpayX, especially, cater to customers seeking seamless, mobile-first banking solutions without the need for physical branches, thus improving accessibility.

Insurtech:

Insurance technology, as the name suggests has made insurance more accessible, affordable, and customizable for Indian consumers. Platforms allow users to compare policies, find competitive rates, and purchase coverage instantly online. Some of the big insurtech players include PolicyBazaar and Acko General Insurance.

Wealth Management:

Wealth management fintech platforms like Zerodha and Groww have made investing an option for all by with lowering entry barriers. Through mobile apps and intuitive dashboards, these platforms provide tools for investment planning, portfolio tracking, and financial goal setting.

Also Read: How Many AI Startups Are There in India?

How does FinTech help in lending? | Lending and Risk Management

Lending fintech companies in India serve not only individual and business borrowers but also provide lenders with advanced tools to accurately assess risk.

In the past, getting a loan involved time-consuming visits to banks, lengthy paperwork, and extensive financial checks. Now, with fintech lending, consumer loan applications can be completed and funds disbursed with just a few clicks on a smartphone, allowing for a faster and more streamlined borrowing experience.

A smart lender cannot trust borrowers at face value. Fintech solutions utilize artificial intelligence (AI), secure APIs, and historical banking data to provide insights into a borrower’s financial habits.

These tools allow lenders to make well-informed decisions, minimizing risks and finally increase trust in digital lending. As a result, fintech lending creates a mutually beneficial environment where both borrowers and lenders can engage with increased confidence and security.

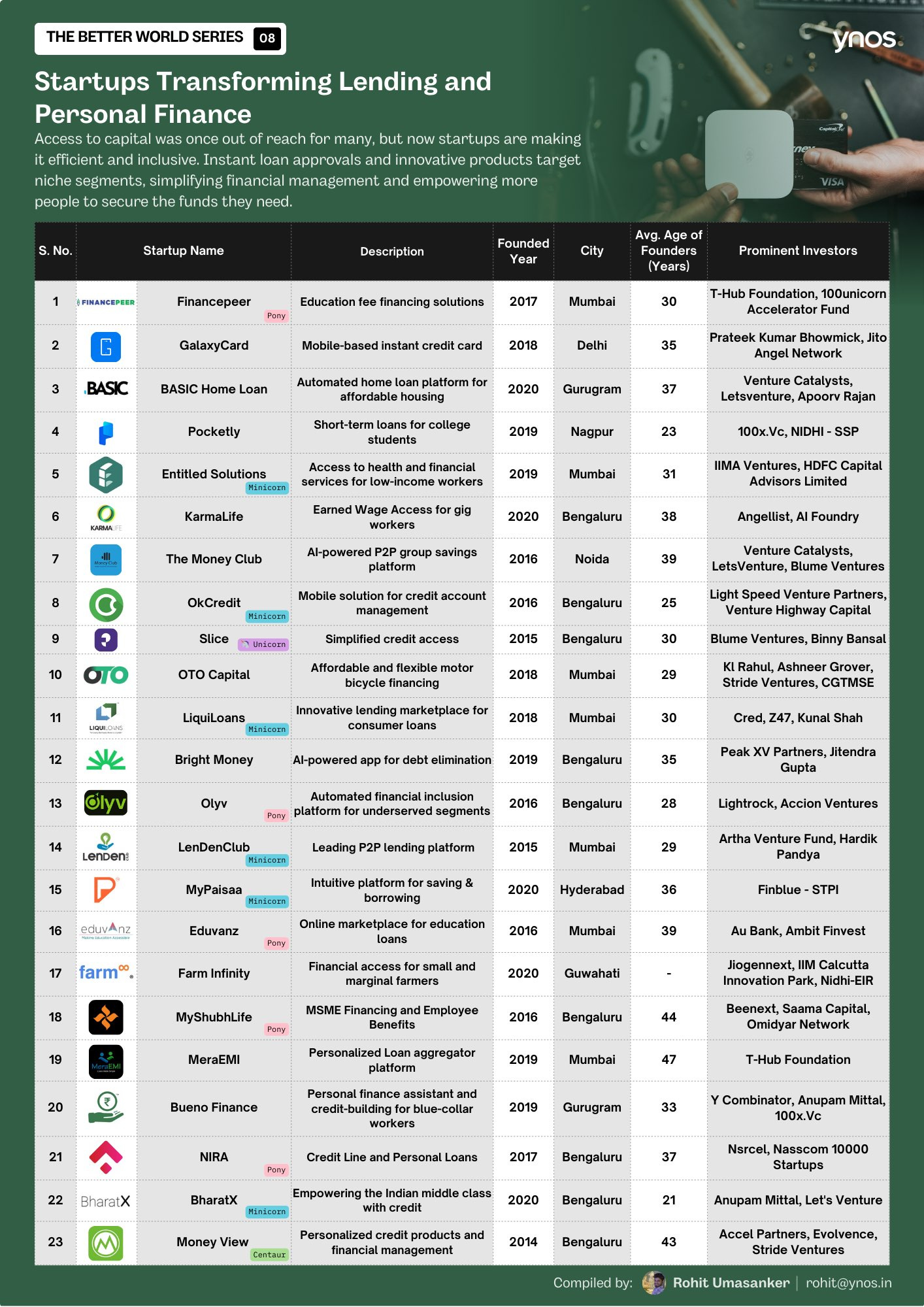

Below are some leading fintech lending companies in India:

Operated by INNOFIN Solutions Private Limited, LenDenClub is a peer-to-peer (P2P) lending platform connecting investors seeking returns with borrowers in need of short-term personal loans. This marketplace simplifies access to credit while providing lenders with better yield opportunities. Backed by investors like Alok Bansal and Artha Venture Fund, LenDenClub stands out for creating direct, beneficial lending connections.

Lendingkart is a fintech company specializing in working capital loans for SMEs. With the help of big data analytics, Lendingkart evaluates borrower creditworthiness efficiently, offering financial support and automated credit decisions tailored for small businesses. Investors such as Abhay Singhal, Ashvin Chadha, and Alteria Capital have shown trust in Lendingkart’s mission to make funding more accessible for SMEs.

Designed to support students, Pocketly offers a transparent lending platform providing short-term loans with the chance for users to raise their credit limits through timely payments. Focused on alternative lending, Pocketly partners with RIIDL Somaiya Vidyavihar, Mumbai, and 100X.VC. This initiative brings affordable financial options to young borrowers and promoting financial literacy.

How Does FinTech Help Consumers? | Personal Financing and Management

Personal finance fintech provides consumers with powerful tools to manage, grow, and invest their money, making financial planning easier and more effective.

These platforms come with a range of features for budgeting, investment management, expense tracking, and strategic financial planning, all aimed at simplifying complex financial tasks.

With a single application, users can track spending, set budgets, and even handle payments, loans, and insurance, creating a one-stop solution for all financial needs. The budgeting tools highlight financial strengths and liabilities, offering suggestions and rewards to encourage better spending habits and financial discipline.

With the help of daily expense tracking and categorizing transactions, these applications give users insights into their financial habits, allowing them to make informed decisions that align with their goals.

The main aim is to improve users’ overall financial health over time by motivating them to set and reach important financial milestones. With real-time tracking and tailored insights, personal finance fintech not only streamlines money management but also helps users to achieve greater financial stability and freedom in the long run.

Following are some well known Fintech startups in consumer lending in india:

NIRA is a consumer finance business in India focused on providing small-ticket loans to low-income, salaried individuals, with a vision of becoming a leading financial brand catering specifically to “Middle India.”

Their focus is on consumer lending, through which they aim to bridge financial gaps for underserved segments. The company has received support from Bengaluru’s K-TECH Innovation Hub, run by NASSCOM, and its investor base includes Charles McGarraugh and Bossanova Investimentos.

MyPaisaa is an app-based platform offering chit fund investments, allowing users to both save and borrow within their own funds. The app is designed to provide flexible investment options and gives users various plans based on their specific financial needs.

Supported by FINBLUE Software Technology Parks of India (STPI) in Chennai, this fintech startup is making traditional chit funds more accessible and efficient.

Groww, developed by Nextbillion Technology Private Limited, is an investment platform that offers the consumers a wide range of investment options. It allows users to discover and invest in the best Stocks, Mutual Funds, US stocks, Futures & Options (F&O's), Fixed Deposits (FDs), and IPOs.

With Groww, users can also open a Demat account and trade in Indian stocks seamlessly. The platform provides objective evaluation of Mutual Funds, prioritizing user convenience and hassle-free investment experience.

Final Words

The Fintech space in India is evolving at a blistering pace. There are multiple new companies emerging from different regions and they are all bringing something new to the table. This means that the competition in the segment will soon be fierce. However, it also indicates a large market space that can accommodate so many players profitably. The playground is wide and accessible. All you need to do is know the rules and play the game well.

The list of opportunities for new startups is increasing. Easy lending, better interest rates, flexible repayment methods; these are all some of the points that land on the green side of the pros and cons. Thankfully, the cons are limited and only affects the business that lacks proper knowledge before commitment. The boom in the fintech market in India means that there are both large spaces and interstitial spaces for new startups to emerge and grow. The question is, how can your company take advantage of this opportunity?

Insightful read! 👏 India’s fintech boom shows how innovation and inclusion can redefine finance. At Artha Fintech (https://arthatech.net/), we empower startups with BaaS and white-label neobank solutions to drive this digital shift. 🚀

I am extremely interested to come up with a startup - small ticket company on fintech