Top 4 Alternatives To Venture Capital You Can Choose From

Venture capital has been one of the most popular sources of funding for startups in the past decades. According to YNOS, there are a total of 4,807 VCs in India with 600+ VCs in Maharashtra alone!

Venture capital has been one of the most popular sources of funding for startups in the past decades. According to YNOS, there are a total of 4,807 VCs in India with 600+ VCs in Maharashtra alone!

Beyond capital injection, Venture Capitalists provide invaluable expertise, elevating your business profile and enhancing credibility. In fact, entrepreneurs often view VC funding as an important milestone in their business growth. However, in recent times, there has been a notable shift in preferences, with individuals increasingly exploring other alternative funding channels.

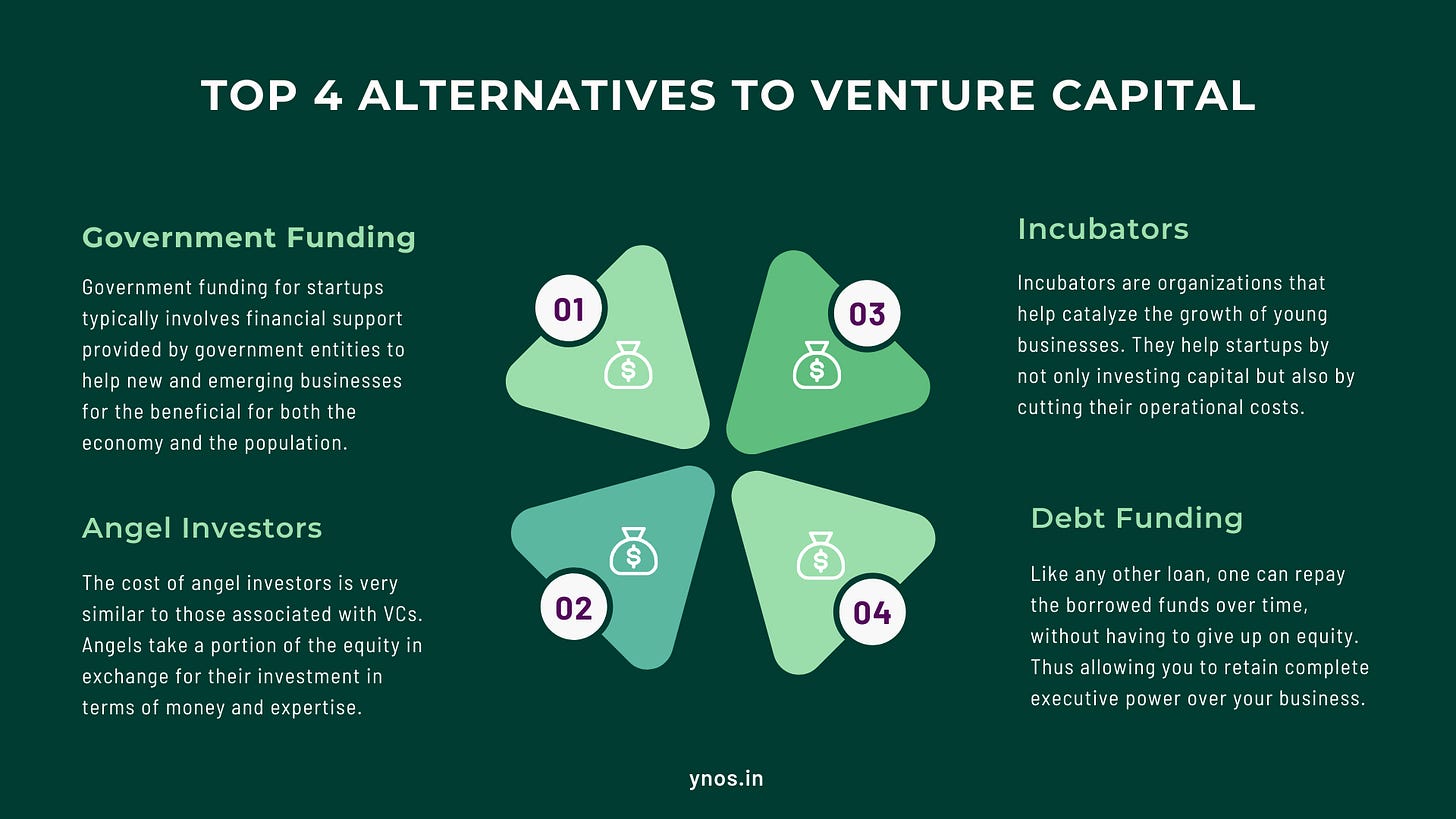

From narrow, specialized profiles to high capital costs, there are many reasons why VCs are finally losing a bit of their appeal. Following are the top 4 alternatives to venture capital funding that every business owner should be familiar with:

1. Government Funding

The government wants people to start new businesses and boost the economy. Products and services produced locally offer advantages to both the economy and the population.

So it is not shocking that there are hundreds of different government schemes that are made for different growing businesses and serve as the perfect alternative to venture capital.

The government of India, for example, has launched 100+ government funds and schemes that help different classes of people in building their businesses.

From MSME schemes to government funds for female entrepreneurs in rural parts of the country, there is something for every businessman and businesswoman. Some well-known startup grants/schemes are the Startup India Seed Fund Scheme (SISFS), the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) Scheme, and the Atal Innovation Mission (AIM).

2. Angel Investors

Angel investors are people who have got a big wallet and an eye for promising startups that either they want to make money from or are genuinely passionate about (and want to make money from it).

The cost of angel investors is very similar to those associated with VCs. Angels take a portion of the equity in exchange for their investment in terms of money and expertise. One reason why you may choose an angel as an alternative to VCs is that they usually do not interfere in business decisions and assume a strictly advisory role.

Entrepreneurs can approach angel investor networks to get in contact with these affluent investors and get them on board with your business. As per YNOS, there are nearly 11,000 angel investors in India who have invested in 8,000 startups and the number is on the rise!

3. Incubators

By definition, incubators are organizations that help catalyze the growth of young businesses. They help startups by not only investing capital but also by cutting their operational costs.

Startup incubators in India do this by providing startups with technological facilities, expert business advice, monetary support, mentoring, and operation facilities and helping them network in the industry.

In turn, incubators help accelerate both regional and national economic development. Broadly, there are two types of business incubators: non-profit and for-profit incubators. The former promotes the country’s economic growth and public welfare, while the latter aims to generate profit in the long run.

Just like plants flourish in an incubator, startups flourish in business incubators. One of the biggest merits of incubators is that they also offer access to other funding sources like angels, VCs, and debt funding.

While the initial support is beneficial, some incubators take equity in the startups they support, which can lead to a loss of ownership for the founding team. Moreover, the dependence on incubator resources may create a reliance that hampers the startup's ability to operate independently in the long run.

4. Debt Funding and Venture Debt

Over 13,000 startups in India have been debt-funded, making it the most predominant method of raising funds in the country. As the name suggests debt funding involves borrowing money through loans, bonds, and other debt instruments.

Like any other loan, one can repay the borrowed funds over time, without having to give up on equity. Thus allowing you to retain complete executive power over your business. With complete ownership of the company, owners need not share their decision-making authority with the lenders.

Of course, there’s a catch. Debt comes with interest and other binding clauses. With strict interest payment schedules and other repayment obligations, it is imperative for entrepreneurs to do meticulous financial planning.

Venture debt is a subtype of debt funding another important alternative to venture capital for startups. This debt is tailor-made for the needs of startups and high-growth businesses. Business owners can reach out to bank and non-bank lenders for venture debt. Select startups can even apply for a government-funded venture debt scheme, namely the Credit Guarantee Schemes for Startups.

Its merits include flexible repayment terms and support for rapid scaling without immediate financial strain. It complements equity financing, enabling startups to extend their runway.

If not done intelligently, debt funding can be a rather expensive form of raising funds, given the risks and planning required to do it right. Entrepreneurs must weigh these considerations carefully, recognizing that debt funding offers both benefits and risks.

The Takeaway

Getting a startup off the ramp can be as difficult as getting a rocket into space. The difference is that a rocket needs fuel and a startup needs cash. While venture capital is a great option, there are various other alternatives for raising money for a new venture.

From government schemes to debt funding, there are countless other alternatives to venture capital funds to get your startup ahead and above. With the landscape in India changing for startups, along with a pro mentality amongst the people, we can expect nothing but growth in terms of options for funding. The question is, are you taking the complete advantage of it?